FNCE 640 Financial Management

An in-depth comprehension of sound financial management concepts leads to good financial decision-making in practice. The course exposes students to financing, investing, and operating activities of a corporation. Other topics include budgetary planning, working capital management, cost of capital and capital budgeting evaluation, optimal capital structure, risk application and international financial management. In addition to problem solving, cases and research papers, the students will experience a merger and acquisition simulation.

Units: 3

This course focuses on providing students with the analytical tools necessary in making value-creating financial decisions. Through in-depth discussions of theoretical foundations and their practical implications on financial decision-making, the students would develop the functional know-how needed for the role of being a corporate financial manager.

Topics covered in this course include the introduction and use of financial tools such as financial statements, cash flow, and financial planning, ratio analysis, and time value of money; stocks and bonds valuation; risk, return, and the cost of capital; making capital budgeting decisions; making long term financing decisions, and the optimal capital structure; and working capital management.

|

WHO NEEDS THIS COURSE? Graduate students:

This course may also be taken by

|

TIME INVESTMENT 5-8 hours a week |

COURSE OUTCOMES

Upon completion of this course, the students will be able to:

- Examine the four key components of the stockholders’ report: the income statement, the balance sheet, the statement of retained earnings, and the statement of cash flows.

- Discuss the use of income-statement/balance-sheet figures to assess a firm’s financial condition. Three types of comparative analysis are noted—cross-sectional, time-series, and combined—and specific ratios for such analysis are presented for five perspectives on firm condition—liquidity, activity, debt, profitability, and market.

- Discuss the time value of the money concept. The present and future value of a sum and an annuity are explained. Special applications include intra-year compounding, mixed cash-flow streams, mixed cash flows with an embedded annuity, perpetuities, loan amortization, and deposits necessary to accumulate a future sum. The discussion employs numerous business and personal examples to stress all applications as variations on the same theme.

- Discuss interest-rate and bond-market fundamentals. Use the bond valuation model in different bonds, explaining the impact of variation in coupon/principal payments, timing of coupon/principal payments, and required rates of return on the market price of a bond.

- Discuss the basic model for valuing equity is presented as an example of asset valuation. Specifically, the value of a share or common of preferred stock. The discussion then expands the common-stock valuation framework to accommodate different assumptions about expected dividend growth, other approaches to equity valuation—ranging from variations on dividend-discounting like the free-cash-flow model to models based on market benchmarks like price/earnings multiples—are also compared and contrasted with the expected-dividend model.

- Provide a detailed exploration of the three approaches to project evaluation—Payback Period, Net Present Value (NPV), and Internal Rate of Return (IRR), and reviewing the pros and cons of each approach.

- Synthesize guidelines in getting good estimates of the relevant cash flows, focusing on the basics of determining relevant after-tax cash flows of a project, from the initial cash outlay to annual cash stream of costs and benefits and terminal cash flow.

- Discuss operating and financial leverage and the associated business and financial risks. As a prelude to operating leverage, breakeven analysis is explained (and its limitations noted) with help from pictures and algebra. The degree of operating, financial, and total leverage is introduced and developed as tools for measuring the risk of the firm associated with different operating and financial structures. Finally, the notion of optimal capital structure— the mix of debt and equity that maximizes firm value—is introduced conceptually along with the EBIT-EPS and valuation model approaches to evaluating capital structure.

- Discuss the management of three major current asset accounts: cash, accounts receivable, and inventory. Also discussed are general inventory management policies, international inventory management, and several specific inventory management techniques: ABC, economic order quantity (EOQ), reorder point, materials requirement planning (MRP), and just-in-time (JIT). The key aspects of accounts receivable management are discussed: credit policy, credit terms, and collection policy. The chapter also discusses the additional risk factors involved in managing international accounts receivable. Examples demonstrate the effect of changes in credit policy. Also discussed are the impacts of changes in cash discounts. The chapter describes how managers and individuals often have to make choices that involve tradeoffs between quantity and price.

TOPICS TO COVER

| Week 1 |

The Role of Managerial Finance |

| Week 2 |

Financial Statement and Ratio Analysis |

| Week 3 |

Time Value of Money |

| Week 4 |

Interest Rates and Bond Valuation |

| Week 5 |

Stock Valuation |

| Week 6 |

Capital Budgeting Techniques & Capital Budgeting Cashflows |

| Week 7 |

Leverage and Capital Structure & Payout Policy |

| Week 8 |

Working Capital and Current Assets Management |

| Week 9 |

Current Liabilities Management |

COURSE FACILITATOR

|

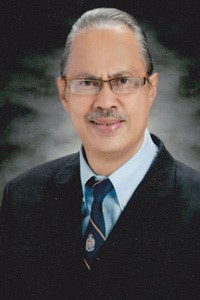

David Lumowa, PhD Dr. David Lumowa is an assistant professor of the Business Department of the Graduate School at the Adventist International Institute of Advanced Studies. He teaches Financial Risk Management, Advanced Corporate Finance, and Entrepreneurship. He is a certified Broker, Underwriter, and Investment Manager. He holds a Master of Commerce in Applied Finance at the University of Queensland, Australia, and a PhD in Business at the Adventist International Institute of Advanced Studies, Philippines. He has been teaching business courses in the field of finance for nearly 20 years. He is passionate about research. In fact, he is the CFO of the Asian Qualitative Research Association (AQRA), and a committee member of the Asia Pacific Research Center(APRC). He loves diving and is a Certified Rescue Diver (CMAS-3) and a Certified Dive Master (CMAS-4). |

COURSE DEVELOPER

|

Eric Nasution, PhD Dr. Eric Nasution is an emeritus professor at AIIAS. He has rich and vast experience in finance both in professional and academic settings for many years. He served as a financial analyst/auditor, managing director, vice president for investment banking, deputy manager, and AVP financial service officer in various companies and banks both in the Philippines and Indonesia. His expertise in the field of finance has contributed a lot to his teaching career. Prior to his retirement, he served as a professor and chair of the Business department, dean of Economic Faculty and vice president for Academic and dean for Graduate School at AIIAS, Swiss German University, and Sekolah Tinggi Ilmu Ekonomi Jakarta respectively. |